The Role of Technology for Stocks in Shaping the U.S. Stock Market

The influence of technology on stock markets is real. Trading is increasing as more and more smartphones are landing in the pocket and the reach of the internet is spreading.

As per the survey, over 4 billion active web users account for half of the world’s population. Modern technology has made our lives faster, feasible, and fun. If you want to succeed in trading, there’s no better solution than embracing technology.

Technology and the US Stock Market

The US stock market has transformed with technology. Google, Facebook, Twitter, etc. like tech giants have overtaken a huge part of the US stock market. Technology has made transactions secure leading the way to a more transformed world as well as the inclusion of tech giants in the US.

Brokers have lost their voice in a good way because they don’t have to tell anymore to exchange orders. The inclusion of technology has also made stock markets easier because now they have become friendlier with faster trade settlement, increased transparency, enhanced security, automated surveillance, and much more.

Technology has redefined Investing in the Stock Market

Technology has completely transformed the way stocks are traded. It has nearly impacted every aspect of trading. Below are some of the key influences that technology has made on the stock market:

Increased Liquidity

The increased speed and efficiency of stock trading have made markets liquidate at speed. Now investors can buy and sell stocks easily. This has been leading the growth of the stock market.

More Competition and Risks

The stock market is seeing more and more competition these days with the courtesy of technology. New investors are joining the vastly growing financial market. More tech-savvy users take advantage of technology over traditional investment firms.

With the increased competition, technology has also introduced us to new risks. The risk of cyber attacks and the potential for algorithmic errors are the most significant risks that involve the technology. This can change the stock markets entirely for the good.

Enhanced User Experience

User experience is a driving force in the stock market. Top companies understand this fact deeply, and they’re ensuring a better user experience with each update that has elevated it to unprecedented levels.

Stockbrokers and trading apps cater to intuitive interfaces, personalized dashboards, and user-friendly features to make things convenient for both seasoned investors and newcomers. This accessibility makes things more inclusive and diverse for investors.

Role of Technology in Stock Market

The role of technology in the stock market spreads out to nearly every aspect of the investment process. Below are some of the ways technology has been shaping the stock market:

Use of Online Apps in Trading

Online trading apps are leading the race in a complete transformation of the trading experience. Days have become the past when you would worry about hiring brokers and then be vexed about monetary losses, paperwork, and many more. With the apps, the trading experience is nearly flawless. Some of the key benefits that trading apps offer include:

- The trading experience is hassle-free.

- Trading is now more convenient and accessible.

- They provide a better understanding of money.

- Remove the worries of hiring a middleman.

- The perk of trading is now in your fingerprints.

- Users can have a better understanding of stocks.

Overall, trading apps have made the experience more feasible, reducing the trading cost and hassle that makes things overall more lucrative.

Use of AI in the Stock Market

AI has proved to be a game changer for investors. The future of trading is now in the hands of AI to reshape. As per reports, the electronic trading portfolio accounts for nearly 45 percent of revenues in trading. Big data processing and machine learning technologies help big companies incorporate quantitative trading, providing real-time market analytics.

AI tools are also available for prediction. Some of those tools include:

- Auquan

- EquBot

- Trade Ideas

- Blackbox Stocks

Automated robots analyze thousands of data points each moment which lead to minimal prices and eliminates risks. Furthermore, it enhances accuracy and ensures maximum return.

Use of Blockchain in Trading

Blockchain technology is ruling stock markets globally to make transactions faster and secure transactions. It takes secure trading and monitoring risks to the next level. Many market regulating authorities are willing to use blockchain in their infrastructure, including:

- Japan financial services agencies

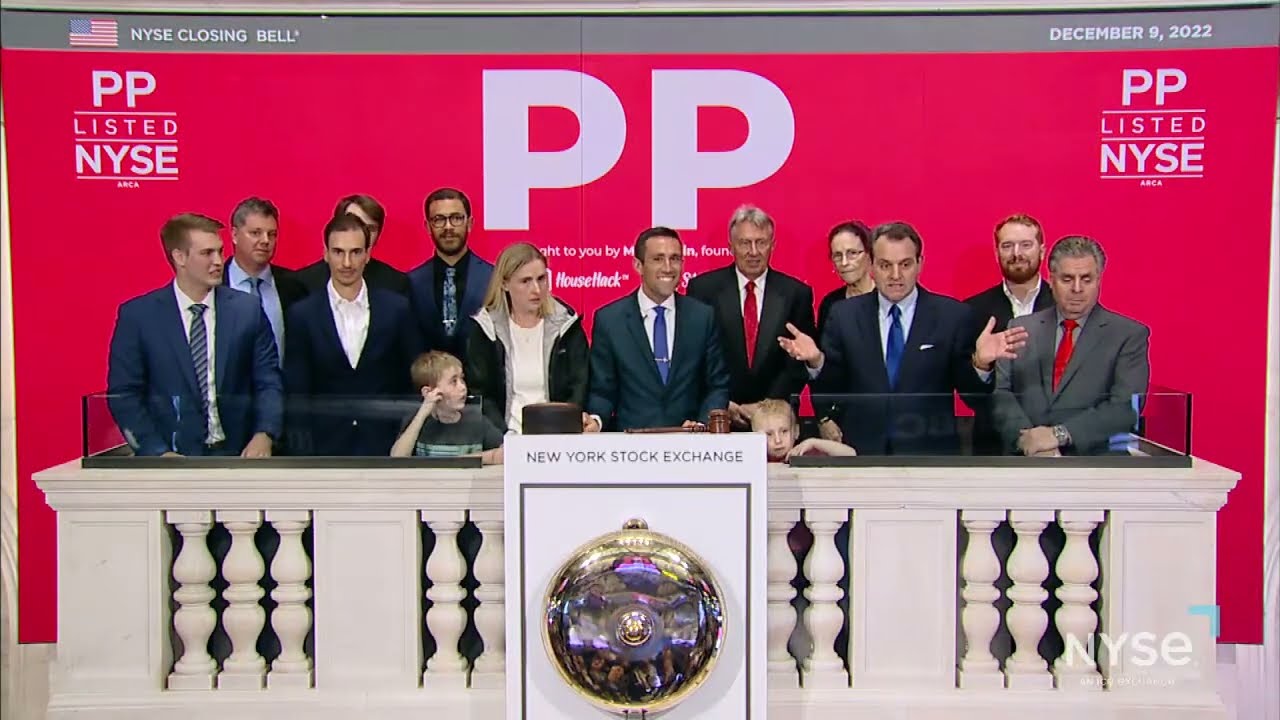

- NYSE

- Deutsche Borse

SEBI has also taken steps to incorporate Blockchain technology and derive benefits. The use of Blockchain technology has numerous defining benefits, including:

- Eliminate the risk of third-party authorities with smart contracts and network regulation.

- Use of automation to make faster trade settlement.

- Provides a robust platform for tracking and reporting illegitimate activities.

- It provides infrastructure for fast trade settlement by reducing operational risks.

- Blockchain technology is capable of transforming the stock markets entirely and can provide:

- Robust security measures

- Automated surveillance

- Higher liquidity

- Lower transaction cost

- And much more.

- Faster Transaction

Stock market participants had to go through a hectic and time-consuming process. They would require the services of an intermediary to regulate transactions. With the advancement of technology, stock markets offer faster and more secure transactions. As the role of intermediaries has reduced, many monetary issues such as manual records, audits, and verification are also eliminated from the market.

Feasible for Masses

Trading apps and websites offer the most key details that make investing a lot easier for every person. Technological advancements have reduced the entry barriers that have significantly reduced overall costs. Now, investors don’t have to pay for speeding up the process for a quick settlement. With the reduced costs, people who wouldn’t invest due to higher costs can participate in the investment processes.

Challenges and Future Trends

Where technology has introduced us to several benefits, it has also had a drastic impact through involved risks like cybersecurity and market volatility. However, the future of trading is likely to experience more transformative trends.

Trends are likely to bring new horizons and introduce new challenges with lasting impact. Transformative trends include:

- Integration of virtual reality in trading platforms

- Enhanced data analytics

- Continued development of decentralized finance (DeFi)

Transformations will continue as technology evolves. Investors who embrace these advancements and use them in trading will reap the benefits of changing the investment landscape. As per current trends, financial markets are likely to be unrecognizable from what we see today. The immense level of advancements in the financial markets will disrupt and transform the investment landscape in the upcoming years.

As we continue to embrace innovations, the stock market is poised for a future where technology is going to become the driving force. So investors need to stay ahead of the curve by keeping themselves informed of the changing technological landscape. To achieve desired results with the changing financial landscape, investors will embrace the opportunities presented through innovation. This is the way forward to make the most out of investments and capitalize on a new financial landscape.

Frequently Asked Questions:

How did technology make the stock market more efficient?

Streamlining of the stock trading process has the most significant impact on the stock market. Online trading platforms provide a huge opportunity to buy and sell stocks without the need for intermediaries. Trades now happen at faster rates with the use of high-frequency trading algorithms using complex algorithms and advanced computer systems.

How are stock markets more accessible these days?

With advanced technology, investors can buy and sell stocks easily. Online trading platforms give opportunities for investors to invest from their computers or mobile devices. This approach eliminates the need for a broker to physically execute trades. Real-time market data makes important information accessible to investors to make informed investment decisions.

How does artificial intelligence impact the stock market?

Artificial intelligence (AI) and machine learning assist in analyzing market trends, predicting stock prices, and generating trading signals in the stock market. AI systems make processing of those vast data possible in real-time that are difficult for humans to make. AI-powered trading systems are used by hedge funds and other financial institutions as they are becoming sophisticated.

Are there any risks associated with the use of technology in the stock market?

Technology has taken investing to an unprecedented next level. But it has also introduced us to many risks like the risk of cyber attacks and the potential for algorithmic errors. They can make a huge difference in the stock market.

Did technology increase competition in the stock market?

As technology has redefined investing to easy terms, the influx to the market has also evolved giving access to most people easily. The increased speed and efficiency of stock trading have enabled investors to compete with established firms.

With all these different aspects of technology influencing the stock market, the US and global markets are going through transformations. The quality of life has improved a lot and that also has an impact on the market. The Stock Market is now more feasible, secure, and efficient for traders and investors.

The situation is now even so dependent on technology that removing technology from the figure will incur great losses. Simply put, technology has helped the stock market evolve significantly. Considering current trends, technology will continue to shape the future of the stock market!

Share this content:

Biography of a Retail Investor in U.S. Stocks: Vlad Kravec

Introduction to Retail Investing

In the wake of the 2020 crisis, sparked by the COVID-19 pandemic, Vlad made strategic moves in his investment portfolio. The pandemic led to substantial market volatility, presenting both challenges and unique opportunities for investors.

Investment Philosophy and Strategy

Vlad’s investment philosophy is rooted in long-term value investing, inspired by the likes of Warren Buffett and Peter Lynch. He spends significant time researching companies, financial statements, and competitive advantages. He prefers to invest in industries he understands well, such as technology, healthcare, and consumer goods.

His strategy involves:

- Fundamental Analysis: Evaluating a company’s financial health, including revenue growth, profit margins, and debt levels.

- Diversification: Spreading investments across various sectors to mitigate risks.

Staying Informed: Keeping abreast of market trends, economic indicators, and geopolitical events that could impact his investments.

Post Comment